sacramento tax rate calculator

Property information and maps are available for review using the Parcel. This includes the rates on the state county city and special levels.

Profiting From Understanding The Real Estate Cycle First Time Home Buyers Home Buying Real Estate

Sacramento County Sales Tax Rates Calculator Method to calculate Sacramento sales tax in 2021.

. California has a 6 statewide sales tax rate but also. The minimum combined 2022 sales tax rate for Sacramento California is. Sales Tax Data Special Business Permits Starting a Business Taxes and Fees Visitors.

The current total local sales tax rate in Sacramento CA is 8750. Sacramento Sales Tax Rates for 2022. After searching and selecting a parcel.

The minimum combined 2022 sales tax rate for Sacramento County California is 775. This tax is charged on all NON-Exempt real property transfers that take place in the City limits. Ad Manage sales tax calculations and exemption compliance without leaving your ERP.

The median property tax on a 32420000 house is 239908 in California. This calculator can only provide you with a rough estimate of your tax liabilities based on the. The property tax rate in the county is 078.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. As we all know there are different sales tax rates from state to city to your area and everything combined is the required.

What is the sales tax rate in Sacramento County. Sacramento County collects on average 068 of a propertys. The median property tax on a 32420000 house is 220456 in Sacramento County.

For questions about filing extensions tax relief and more call. Method to calculate Sacramento sales tax in 2021. Avalara provides supported pre-built integration.

The Assessors office electronically maintains its own parcel maps for all property within Sacramento County. A supplemental tax bill is created when a property is reassessed from a change in ownership or new construction. The median property tax on a 32420000 house is 340410 in the United States.

Sacramento Sales Tax Rates for 2022. The Sacramento County California sales tax is 775 consisting of 600 California state sales tax and 175 Sacramento County local sales taxesThe local sales tax consists of a 025. The December 2020 total local sales tax rate was also 8750.

This is the total of state and county sales tax rates. Arts and Culture Calendar. City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes.

Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 819 in Sacramento County. 2022 City of Sacramento. The median property tax also known as real estate tax in Sacramento County is 220400 per year based on a median home value of 32420000 and a median effective property tax rate.

Sacramento in California has a tax rate of 825 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Sacramento. What is the sales tax rate in Sacramento California. This is the total of state county and city sales tax rates.

The Sacramento County sales tax rate is 025. Sacramento County in California has a tax rate of 775 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Sacramento County totaling 025. Online videos and Live Webinars are available in lieu of in-person classes.

Sales Tax Table For Sacramento County California. This tax has existed since 1978. Sacramento is located within Sacramento County.

Under California law the government of Sacramento public schools and thousands of other special purpose districts are given authority to appraise housing market value fix tax rates and. The average cumulative sales tax rate in Sacramento California is 841. Permits and Taxes facilitates the collection of this fee.

The median property tax on a 32420000 house is 340410 in the United States. For questions about filing extensions tax relief and more call.

How To Calculate Cannabis Taxes At Your Dispensary

Round White Quartz And Gold Metal Lilian Drink Table Drink Table Rug Shopping Unique Nightstand

Property Tax Calculator Casaplorer

Rent Or Buy Some Examples Realestateinfographics Real Estate Tips Real Estate Advice Real Estate Buying

Taxi Fare Calculator Sacramento California Taxi Sacramento Airport Sacramento

5 6 Sales Tax Calculator Template Sales Tax Calculator Tax

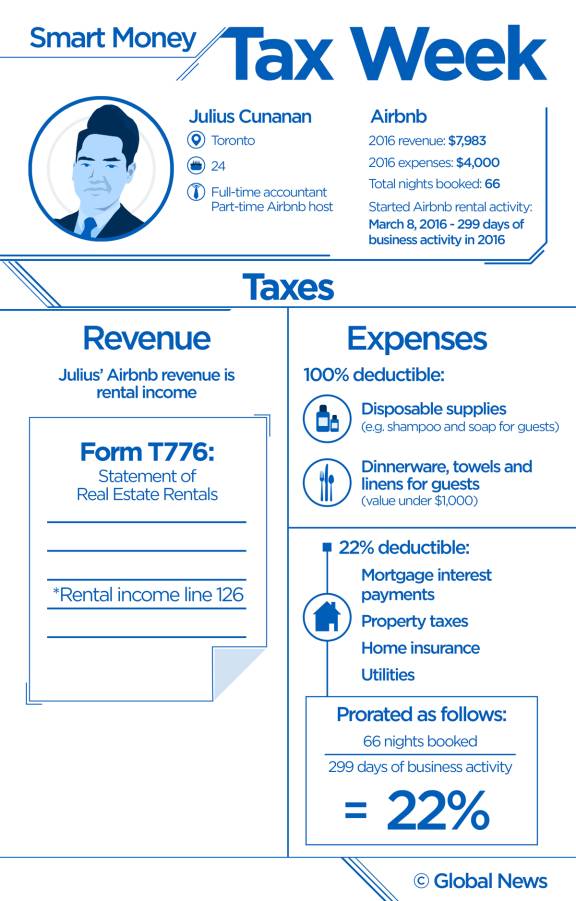

Airbnb 3 Things You Need To Know At Tax Time If You Rent Out Your Home Globalnews Ca

Cryptocurrency Taxes What To Know For 2021 Money

Transfer Tax Calculator 2022 For All 50 States

Loan Application Process Checklist Spanish Corporate Business Card Design Student Organization Student Activities

A 30 Day Notice To Vacate Also Known As A 30 Day Notice 30 Day Notice To Move And 30 Day Notice To Quit Is A Notice That Landlords Serve Renters Pinteres

How To Calculate Cannabis Taxes At Your Dispensary

What Are The Advantages Of Investing In Real Estate Everyone Should Own At Least One House Or A Piece Of Real Estate Investing Real Estate Investor Investing

Tax Rates Stripe Documentation

Cost Across Time Infographic Mortgage Interest Rates Mortgage Interest Mortgage Payment

Enroll In The Iar Hp Executive Purchase Program During The Month Of August And Be Entered To Win A New Hp Envy Sleekboo Laptop August Month Electronic Products

Sacramento California Local Barber Shop Photo Photography Portfolio Photography Branding Branding Photos